Hospital Indemnity: Senior-Focused Product Observations, Part 2

Following up on last week’s blog, this entry will continue a review of several current top-selling Hospital Indemnity (HI) products. Here we look more closely at several specific benefit offerings and the important guaranteed issue feature.

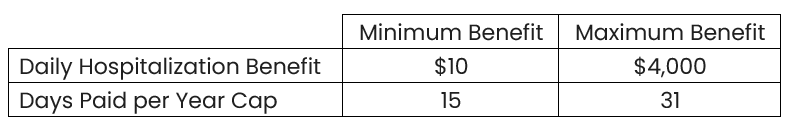

Hospitalization Benefits

All senior-focused HI products offer a “per-admission” hospitalization benefit in addition to a daily hospitalization benefit. Filed daily benefit ranges are shown here:

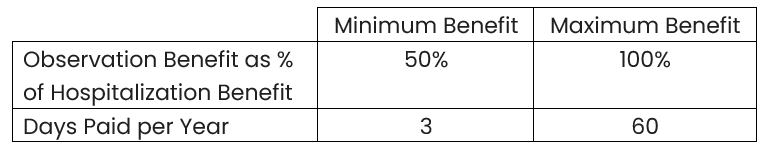

Observation Stay Benefits

In cases where a policyholder spends time in an “observation” room at a hospital and is not necessarily admitted as an inpatient, confusion is a common result. From the policyholder’s perspective, they were hospitalized, even if the hospital and the insurance policy do not consider them admitted. Senior-focused HI policies offer an observation stay benefit, sometimes paid at the same level as the hospitalization benefit, sometimes at a reduced rate.

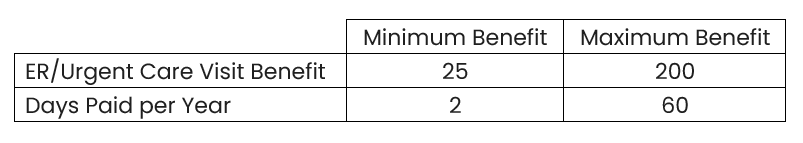

Emergency Room and/or Urgent Care Benefit

Visits to an Emergency Room or Urgent Care center can be very costly, a fact well-known to insurers. A simple indemnity benefit for a visit to one of these locations is nearly always provided. Most policies will pay this benefit even if the policyholder is not ultimately admitted to a hospital, though there are exceptions.

Cancer Benefit Option

Most plans offer an optional cancer benefit rider, paying a lump-sum benefit upon diagnosis of internal cancer.

Numerous benefit variations can be built, with several to note listed here:

Some pay a reduced benefit for diagnosis of skin cancer or carcinoma in-situ.

Some will only pay for a first diagnosis of cancer; if a specific cancer has been diagnosed in the past it may not qualify for benefit payment.

A recurrence benefit is sometimes provided, where the policyholder is eligible for benefit payment upon a repeated diagnosis. Often the specific cancer must have been in remission for a specified period of time before eligible for this benefit.

Guaranteed Issue Availability

Hospital Indemnity coverage is often purchased alongside a Medicare Advantage product, which does not require underwriting to obtain coverage. It can seem unwieldly to require underwriting and a “higher bar” for issuing the ancillary product when that is not required for the primary coverage. Allowing easier access to supplemental coverage for a spouse who may not be the same age is another reason carriers consider guaranteed issue ranges.

Most carriers will issue their HI products to applicants within a specific range of ages without requiring underwriting. This range typically starts at age 64 or 64½. The upper end of this range varies more by carrier, averaging 71 for a set of common plans.

For more high-level information about Hospital Indemnity products you can download our free Product Essentials Guide. For additional data on market size and key competitors, our Market Projection Report is available. Both resources can be found in our online store.

We’d love to hear from you!

Send us a note with your questions and needs, or to find out more: